Your Support is always needed and appreciated! Go OHA!!!

-

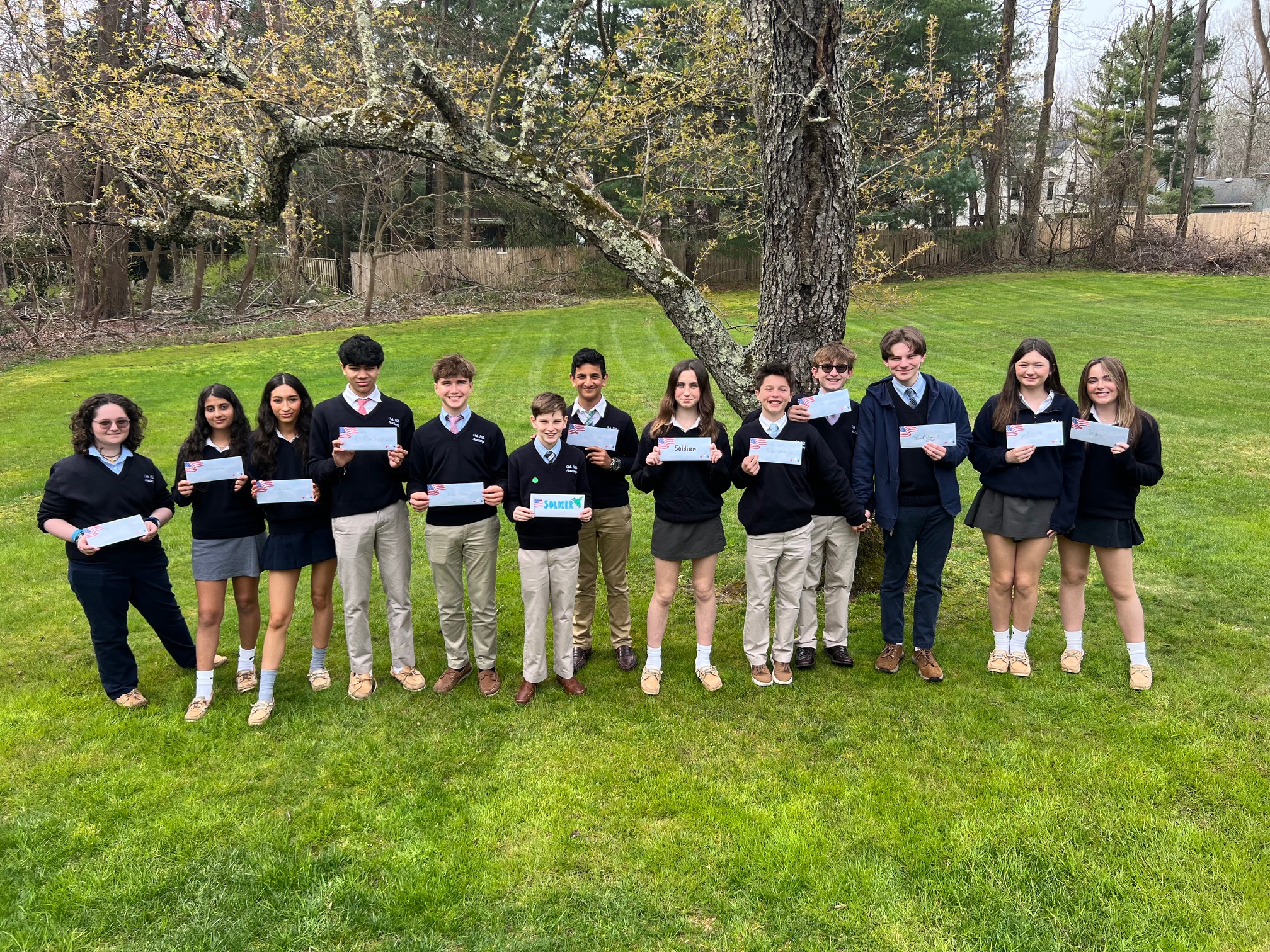

Mustangs Stepping Forward

“Purchase A Paver” program. These engraved pavers will be installed outside our gym building. (8 x 8 Paver is available for $500.) Please make checks payable to “Oak Hill Academy”.

- Click above link for the form

- Payment made online by credit/debit card here

- In Memory of Dorothy “Debby” Borg

-

Planned Giving

A financial gift to a qualified non-profit institution such as Oak Hill Academy provides needed resources and endowment for the school, as well as a likely means of tax savings and even future income for you.

-

Cash

An outright gift of cash is still the most popular means for you to support our school. Your gift prior to December 31 can cost you much less at tax filing time.

-

Appreciated Securities or Real Estate

An outright gift of appreciated securities or real estate entitles you to a charitable deduction equal to the current and fair market value of the asset.

-

Life Insurance

As many people are carefully making their estate plans, some consider the philanthropic benefits of naming a charitable organization such as Oak Hill Academy as the owner and beneficiary of their life insurance policy.

-

Will

Naming Oak Hill Academy as a beneficiary in your will is a generous means for you to help others experience the same benefits as you did at Oak Hill Academy and ensure the future success of our school.

-

Charitable Remainder Trust

Instead of making an outright gift, transferring an asset to a charitable remainder trust can provide you a means of lifetime income and eventually make a nice gift to the school.

-

Charitable Lead Trust

This is similar to a charitable remainder trust; however, Oak Hill Academy is the one who receives the yearly interest income from the trust. Your heirs benefit by eventual receipt of the asset’s principal with a substantial savings in estate taxes.